who pays sales tax when selling a car privately in california

If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax. Important Tax Information for Used Vehicle Dealers.

Learn More About The Appraisal Process With This Simple But Great Infographic Infographic Residential Real Estate Appraisal

The Department of Motor Vehicles Technical Compliance Section at 916 657-6795.

.png)

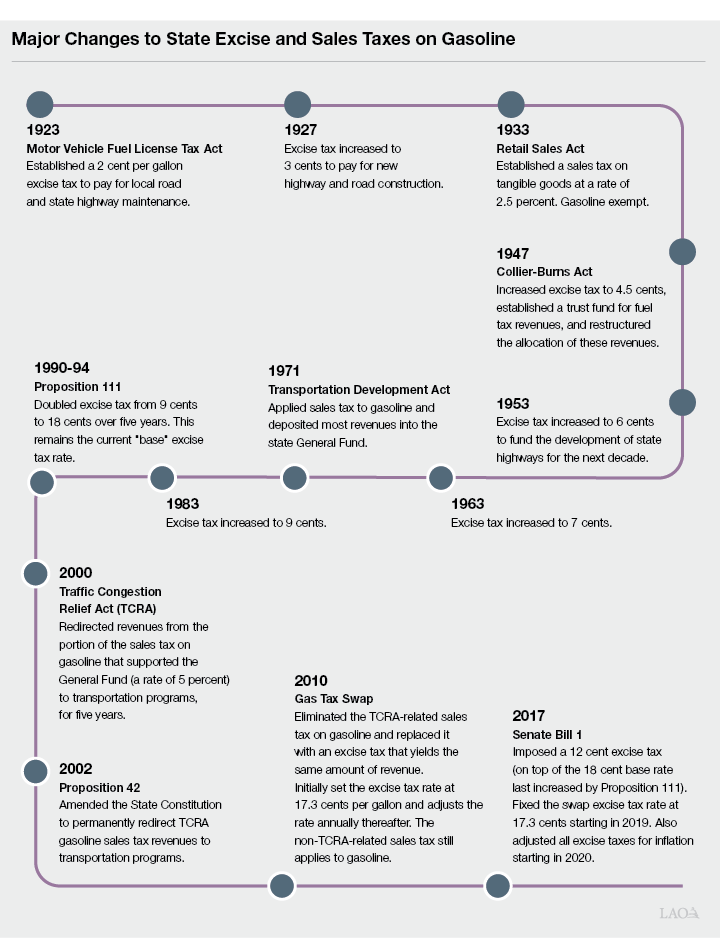

. However the sales tax rate for gasoline is only 225 plus applicable district taxes. The sales tax rate for the sale of a vehicle is currently 725 plus applicable district taxes. The buyer will have to pay the sales tax when they get the car registered under their name.

California statewide sales tax on new used vehicles is 725. Either way the buyer pays the taxes. Use tax applies to the sale of vehicles vessels and aircraft purchased from non-dealers for example private parties or from outside California for use in this state.

The Bureau of Automotive Repair BAR at 800 952-5210 smog emissions information. Do you have to pay sales tax on a used car in California. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle.

The sales tax on diesel fuel is 900 plus applicable district taxes. Their signature is required on Line 1 of the title If the vehicles title has been lost stolen or damaged complete an Application for Replacement or Transfer of Title REG 227 form. If you sell it for less than the original purchase price its considered a capital loss.

Answer 1 of 3. Sellers Permits and the California Department of Tax and Fee Administration CDTFA All Dealers and Auto Brokers must obtain a Sellers Permit from the Department of Tax and Fee Administration before you can collect use tax and file your State Returns. The buyer inspects the car.

Fill out all the required forms review and sign them with the buyers. This means you do not have to report it on your tax return. New legislation Assembly Bills 82 and 85 Chapters 14 and 8 Statutes of 2020 requires sellers of used vehicles to pay to the Department of Motor Vehicles DMV sales tax at the same time.

Other fees you may have to pay when buying a car in California include a 28 California Highway Patrol fee a 1 reflectorized license plate fee a 1 fingerprint ID fee a 6 air quality management district fee a 1 crime deterrence program fee and an 8 smog transfer fee. When you buy a car from a licensed auto dealer they collect the tax that you pay and send it to the state. Review and gather the California DMV forms.

The vehicles title sometimes referred to as a pink slip signed by the person selling the car. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Most auto shoppers who buy a car privately pay for a pre-purchase vehicle inspection by a qualified and licensed auto mechanic.

For a private-party sale the buyer will pay tax to the California Department of Motor Vehicles DMV when registering the car. If you are legally able to avoid paying sales tax for a car it will save you some money. To take over ownership of a vehicle you will need.

Car registration is 60. California statewide sales tax. Smog transfer fees are only necessary if your car is four model years.

Be prepared to pay transfer title registration taxes and other fees. Do not let a buyer tell you that you are supposed to. Thats on top of the gas tax the insurance tax and all the other taxes associated with operating your car in California.

However if you sell it for a profit higher than the original purchase price or what is. If a car changes hands 3 times in the first 5 years of its life the state collects about 25 of the total cost of the car. Income Tax Liability When Selling Your Used Car.

S NHTSA odometer disclosure requirements were updated in December 2020 impacting certain private vehicle sales in California. In California a licensed dealer must offer the purchaser of a used vehicle that costs 40000 or less the option to buy a 2-day cancellation policy before they sign any paperwork. California Used Car Return Laws.

For a vehicle transfer that occurs from January 1 2021 through December 31 2030 any. For example sales tax in California is 725. 725 The sales tax rate for the sale of a vehicle is currently 725 plus applicable district taxes.

For more information on out-of-state vehicle purchases issues look to. Certain dealers licensed exclusively to sell used vehicles face changes in the way they pay sales taxes beginning January 1 2021. In addition you may have to pay as extra as 25 if.

Get a smog certification if your car isnt exempt. If you purchase a used Honda Civic for 10000 you will have to pay an additional 725 in sales tax. California sales tax generally applies to the sale of vehicles vessels and aircraft in this state from a registered dealer.

However the sales tax rate for gasoline is only 225 plus applicable district taxes. For example if you received a 3000 rebate on your vehicle and it decreases the total cost to 7000 you still have to pay sales tax on 10000 says the Sales Tax Handbook. The California Air Resources Board ARB at 800 242-4450.

Effective January 1 2021 most Dealers must pay the sales tax they collect from customers directly to the DMV. When you buy a car from an individual you pay sales tax when you register it. What is California sales tax on vehicles.

The sales tax is higher in many areas due to district taxes. In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets. Some areas have more than one district tax pushing sales taxes up even more.

Pair that with the crazy registration fees and it amounts to straight up extortion. This means that the purchaser will either have the option to cancel the transaction for any reason or to return the used car within.

California Vehicle Tax Everything You Need To Know

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Who Pays For Closing Costs In Ca The Seller Or The Buyer Adhi Schools

Homesmart Real Estate Helping People Real Estate Real

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Electronic Billing Payments Platform Paynearme

What Are The Average Credit Card Processing Fees That Merchants Pay 2022 Update

Closing Costs Who Pays What When Buying Or Selling A Home Tilo Team Real Estate Closing Costs Selling House Home Repairs

California Used Car Sales Tax Fees 2020 Everquote

Does The Seller Of A Used Car In California Pay Taxes Quora

Do You Need To Pay Taxes To Ca Dmv On A Car Lease Buyout Through A New Finance Company Quora

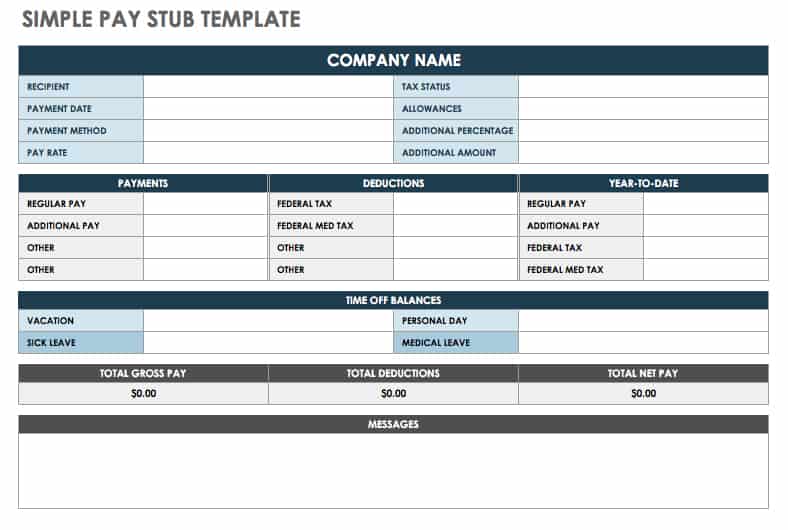

Create Pay Stubs Instantly Generate Check Stubs Form Pros

Free Pay Stub Templates Smartsheet

How To Use A California Car Sales Tax Calculator

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

How To Register Vehicles Purchased In Private Sales California Dmv